Weekend Buzz | Housing Needs Assessment Points to Need for Middle Housing

Common misconceptions continue to block home ownership for young families, seniors, BIPOC

Good Morning and Happy Weekend!

I had the pleasure of chatting with Kerry Donahue of the Housing Partnership this week.

Kerry and the rest of the Partnership have been making the rounds this season, sharing the results of the very thorough Housing Needs Assessment, authorized by Town Meeting in the fall of 2021 and completed earlier this year. This assessment was conducted in collaboration with the Metropolitan Area Planning Council (MAPC) and involved a lot of data crunching as well as qualitative measures such as focus groups, a survey, and a town-wide forum, to learn what kinds of housing issues face our town.

There’s no call to action at this point; the group just wants to share the information with as many Burlington residents as possible. This video summarizes the results of the Assessment. Watch it and read below to learn all about it!

Major Takeaways from the Housing Needs Assessment

Buying a Home in Burlington is Not Affordable for Most People

This won’t come as a surprise, but Burlington home prices have skyrocketed in the last decade. Back in 2011, the median home price was at $385,000. By 2021, ten years later, the price to own a single family home had nearly doubled to $697,000, and in just the last year that number has risen to $735,000.

That means that, assuming your down payment on a home here in Burlington—even a “starter” home—is 20%, you need to be prepared to fork over around $150k in cash just to get your foot in the door. Lots of people (most people?) don’t have that kind of cash lying around, but this especially prices out young families, seniors, and middle- and low-income people (and this category is disproportionately made up of BIPOC individuals).

People who can’t buy often end up renting, but that is becoming unaffordable for most as well. In fact, in the year since the research was complete, the proportion of renters who are cost-burdened (those who spend more than 30% of their monthly income on housing) in Burlington has risen from about one-third to one-half. Eviction rates are troubling, as well, with 22 occurring in Burlington between January and June of 2022.

Overwhelmingly Composed of Single-Family Homes

Burlington, as you likely know, is full of single-family homes and not much else. A quick search on Zillow will show that, while inventory is sparse to begin with (18 listings currently, which is more than in recent history), there is nothing available that’s not a detached single-family house. It has been historically difficult to get small multi-family homes or accessory dwellings permitted, and they’re only allowed in certain parts of town.

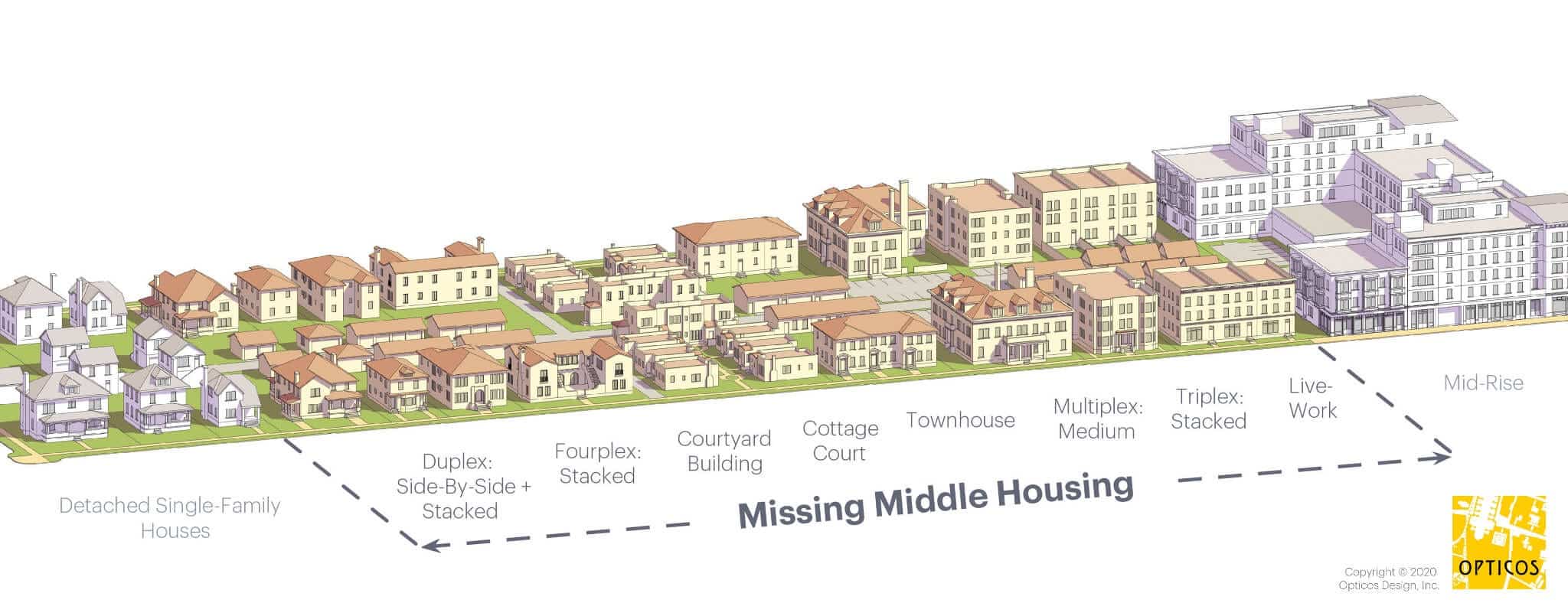

If we look at a nearby town like Lexington, for example, we’ll find some more housing diversity. They’ve got housing types that we just don’t, like townhomes, condos, and multifamily homes. The graphic above, from the Missing Middle Housing website, shows some of the middle housing options that could provide some more affordable housing options for folks that don’t have $150k to lay down on a home or the (I’m not going to calculate it because it’ll make me cry, but probably) $3,500/month to pay on the mortgage.

Young People, Seniors, BIPOC People Most Affected

I learned during this conversation about the concept of the housing ladder, a kind of pipeline that follows someone from childhood through old age. It goes something like this: When young people move out of their parents’ homes, they might rent an apartment for a bit before buying a small “starter” home in the form of a small single family or a condo. Then they’ll upsize as they start having children, and once their children are out of the house they might downsize. As they age they might move to an even smaller place or to an assisted living or nursing facility.

As people move through the far end of this pipeline, it opens up space for others to enter. When the senior moves to senior housing, someone else moves into their condo. When the empty nester downsizes, another famliy upsizes into their former home. And when that family upsizes, another growing family takes their place, and so on.

Unfortunately, what we have now is gridlock. With housing prices approaching the moon, interest rates that keep rising, and the economics making rehabilitating a 1200-square-foot ranch less feasible than tearing it down and building a 4000-square-foot colonial, folks are increasingly just staying where they are—leaving no room for movement through this pipeline. Or up the ladder, whatever metaphor you choose.

This disproportionately affects young families who can’t afford a $700,000 home, seniors and others on fixed incomes who can’t afford to stay in their homes but don’t have anywhere else to go, and people of color who have traditionally been excluded from participating in building generational wealth in the form of home ownership because of redlining and other historical discrimination.

Some Misconceptions About Affordable Housing in Burlington

Before I close out today, I wanted to address some of the most commonly-cited arguments talking points that come up during conversations about affordable housing in Burlington.

Not Necessarily New Construction

It’s important to realize that supporting the affordability of housing doesn’t have to come in the form of huge developments. There are plenty of ways to support affordable housing without building anything new:

- Subsidies and down payment assistance

- Aging in place/grant programs

- Purchasing and rehabbing single family homes

- Bridge loans

Affordable Housing Calculation Artificially Inflates Affordability Numbers

Another thing I was surprised to learn is how the 40B Affordable housing threshold is calculated. From the NeighborWorks Housing Solutions website, “Chapter 40B Housing is a program created by the State of Massachusetts which allows developers to override local zoning bylaws in order to increase the number of affordable homes in municipalities where less than 10% of the housing is defined as affordable.”

The thing about the calculation, though, is that if even one unit in a building is designated as Affordable, all the units in the building count toward that 10%. So, even though we have 13.5% of units on the Affordable housing inventory in Burlington, many of them are actually at market rate. When you remove the market-rate units from the count, what we really have in Burlington is 5.4% Affordable units—and, translating this, for every one Affordable unit available in Burlington, there are 5 eligible households.

That calculation is not unique to Burlington, but it does artificially inflate the number and it makes the town look more affordable than it really is.

Traffic and School Concerns

Often, residents stay they don’t want more affordable or middle housing because it would increase traffic and overtax our schools. It has actually been shown, though, that single family homes add more students to schools than multifamily housing (p. 5) because it’s usually families with school-aged children who are moving into those single-family homes, whereas young professionals or young families with small children tend to move into the multifamily places. And, if folks who worked in Burlington could actually afford to live here, traffic wouldn’t likely get worse—and might actually get better (pp. 8-9), because people who currently drive into town every day could walk, bike, or take public transportation to work.

Hopefully you’ve learned something from this deep dive into the housing needs of Burlington. Read the full Housing Needs Assessment on the town website (or watch this short video about the findings) and feel free to reach out to the Housing Partnership on Facebook for more information.

See you tomorrow!

Nicci